BLOGS

Best Practices for Setting Up Employee Direct Deposits

Direct deposit is the primary method most employers use to pay their employees. It’s a convenient, secure, and efficient way to ensure employees get paid in a timely and accurate manner. Employees don't have to worry about losing their checks and it reduces payroll hassles for employers.

Follow the best practices outlined below to ensure new direct deposit accounts are setup accurately and to safeguard against direct deposit errors, delays, and potential fraud.

Before you begin:

- Documentation: Request official bank documentation from employees. A voided check, bank letter or bank specification sheet will serve not only to confirm the data provided is correct but will also help to protect against fraud. (Do not use bank deposit slips as documentation, as those often do not have the proper information for direct deposit transfers.) Documentation should provide the name on the account, the routing number, account number, and the account type.

- Prenoting: If employees are not able to provide official bank documentation, you may want to prenote their bank accounts. A prenote is a test that is completed to validate the bank information provided. The process takes 5-7 business days. During the testing, the account will be on hold and direct deposit will not be active. If no errors are received during the testing period, myPay Solutions will set the account to Approved and funds will be sent via direct deposit from that point forward. Please note: the prenote testing period must be complete and the account status must be set to Approved prior to time entry for the direct deposit to be processed for the selected pay date.

- Security: Protect your company and employees against fraud. Do not accept direct deposit requests sent to you via email or fax. In today’s digital landscape, it’s easy and convenient to communicate through these channels, but those methods of communication are not secure. There is no way to verify who these types of requests were truly originated by, even if they are sent from a known number or email. You cannot be sure the accounts have not been compromised. If you receive requests via email or fax, be sure to follow up with a second method of authentication (phone call or face to face) to confirm the request is authorized and valid prior to entering the change.

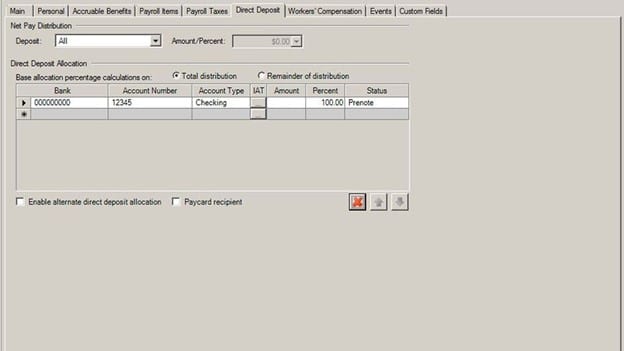

In the Direct Deposit setup screen:

1. Enter in the full routing number.

- Several banks and routing numbers are saved in our database, and many banks have multiple routing numbers based on location. The routing number may autofill after the first few digits are entered based on the first match in our database so be sure to enter the routing number all the way through to the very last digit. Do not select the bank by name as you may be selecting the incorrect financial institution location.

2. Enter the bank account number twice.

- Enter the number in the account field and an additional box will appear for you to type it again. This is to ensure accuracy of the account number.

3. Select the type of account: checking or savings.

- Using the “Account Type” drop down, select “checking” or “savings.” Do not select “Credit Loan” for direct deposit.

4. Enter either the dollar amount, in the amount field, or the allocation percentage in the percent field.

- Employees with a single bank account will typically be set for 100% percent. For employees with multiple bank accounts, please see the Help and How-To Article attached at the end of this article.

5. Set to Prenote (default) or change the status to Approved (if you are certain of the account documentation provided).

- Do not change the Net Pay Distribution fields (Deposit or Amount/Percent) at the top of the Direct Deposit Setup tab or Base allocation percentage buttons (Total Distribution or Remainder of Distribution above the bank information grid). The default settings on these fields should not be changed.