Payroll that works for you

Trusted by 90,000 organizations like yours

Let’s Talk Payroll

Got questions? Our payroll experts are here to help.

Whether you’re exploring new software or considering a switch, we’ll walk you through the best options for your business. No pressure, just expert guidance.

Pick your payroll solution—software, full-service, or global

Your proven partner for all things payroll

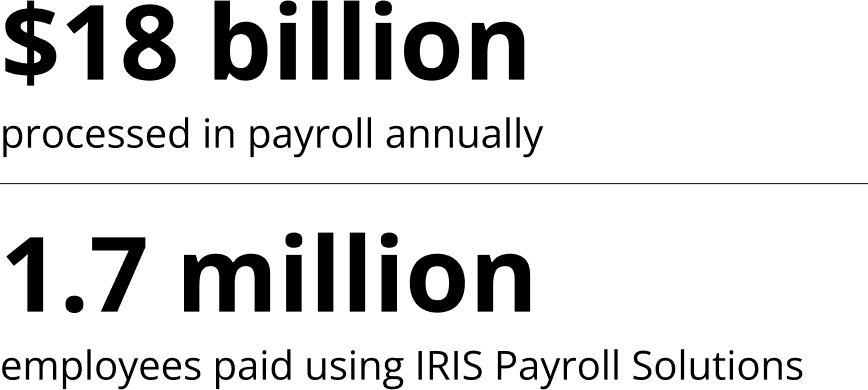

Powering payroll at scale

Every year, organizations rely on our business payroll solutions to process billions in payroll and pay over a million employees. With powerful automation, built-in compliance, and expert support, we help you run payroll with confidence—no matter your size.

Related IRIS Payroll Solutions

Payroll is just the start

Frequently Asked Questions (FAQs)

Learn more about the benefits of payroll solutions for businesses, accounting firms or a payroll service bureaus.

-

Payroll is how businesses pay their employees. It includes calculating wages, withholding taxes, deducting benefits, and making sure payments go out on time. It also covers keeping records and staying compliant with labor laws and tax regulations.

-

Processing payroll, or running payroll, involves a few key steps: gathering employee details (like hours worked, salaries, and tax details), calculating gross pay, deducting taxes and benefits, paying employees (via direct deposit or checks), and filing tax forms.

Some businesses handle payroll in-house using payroll software or a payroll team,for full control. Others outsource it to a payroll service provider, which takes care of everything—compliance, tax filings, and payments,—so they don’t have to worry about admin work, errors, or penalties.

Not sure which approach is right for you? Check out our blog “In-House Vs. Outsourced Payroll: What’s the Difference?” -

Payroll compliance laws make sure businesses

-

A payroll provider is a company that handles payroll for businesses. They manage wage calculations, tax filings, compliance, and employee payments, usually with payroll software to make things easier.

-

It depends on what you need. Think about pricing, features (e.g., tax filing, direct deposit, benefits management), ease of use, and integration with your existing tools.

,Good customer support,and compliance expertise are key, too.

Need help choosing? Our Payroll Software Buyers Guide walks you through what to look for.