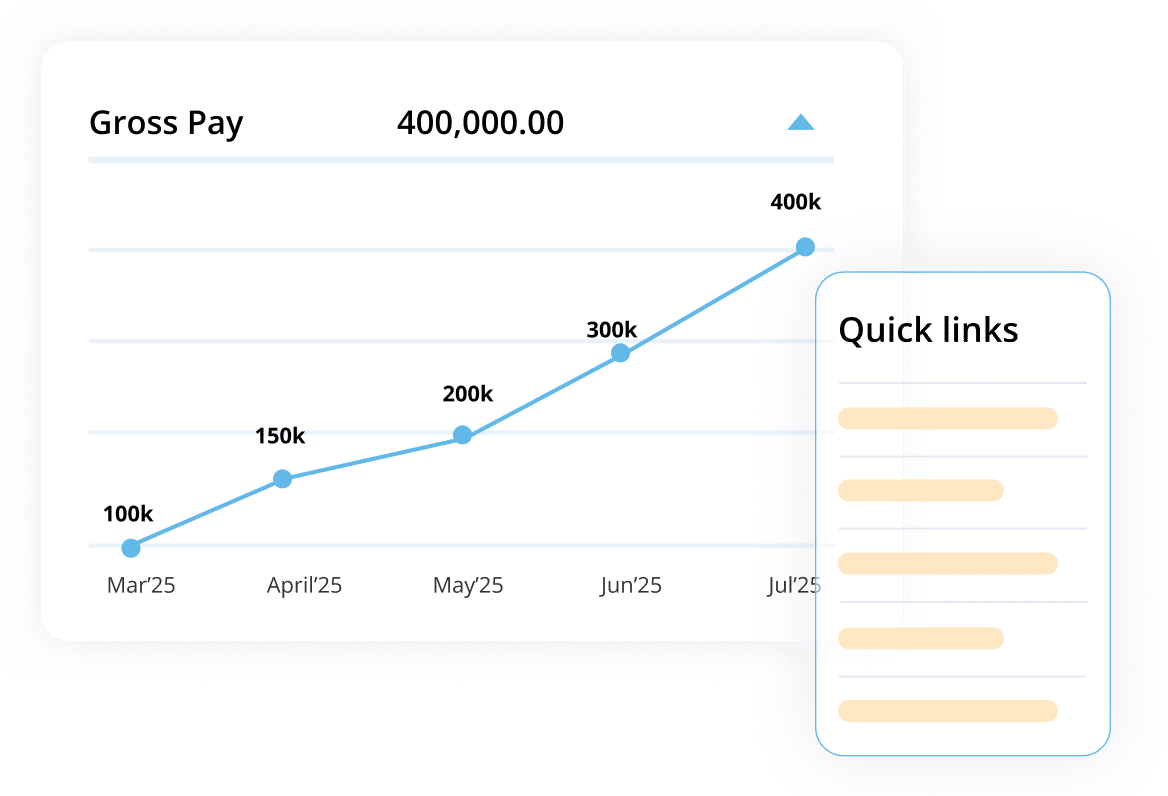

Payroll, simplified. Growth, amplified.

Spend less time on payroll and more time growing your business.

Let’s Talk Payroll

Whether you’re exploring payroll software options for your accounting firm or payroll service bureau, considering a switch, or not sure where to start, we’ll walk you through the best options for your business. No pressure, just expert guidance.

“IRIS’s payroll platform has been a godsend. It has given us the ability, at a reasonable rate, to offer direct deposit, keep our clients’ payroll running, and keep them happy. Of course, revenue has been going up. By moving clients to IRIS, we’ve been able to cancel our old platform subscription and significantly improve our profit margins.”

Rob Bolton, Co-Owner, Stewart’s Business & Tax Service

Trusted by 90,000 organizations like yours

Payroll software that grows with your firm

Manage payroll with ease, whether you serve 1 client or 100. Our payroll software for accountants, payroll service businesses, and bookkeepers saves time and increases earnings with automated workflows, client-friendly tools, and built-in HCM features designed to scale as you grow.

Award-winning payroll, backed by experts

Trusted by businesses and recognized for excellence, our payroll software has earned top marks for support, performance, and reliability. Overwhelmed by compliance? Bogged down in admin? Tired of fixing errors? We’re here to help.

Frequently Asked Questions (FAQs)

Get answers to the most common questions about payroll management software.

-

Payroll software automates tasks like wage calculations, tax deductions, and payslip generation. It ensures accurate payments while maintaining records for compliance and reporting.

-

Look for payroll software that’s easy to use, backed by reliable support, and built for compliance. Scalability and integration with your existing tools are also essential—choose a provider that fits your business needs now and in the future.

-

Yes. Payroll software helps ensure accurate tax calculations, compliance, and proper record-keeping, even for a single employee. It saves time and minimizes the risk of errors.

-

Yes. IRIS payroll software is designed to stay up to date with local, state, and global payroll regulations. Regular system updates ensure compliance, helping you avoid costly mistakes.